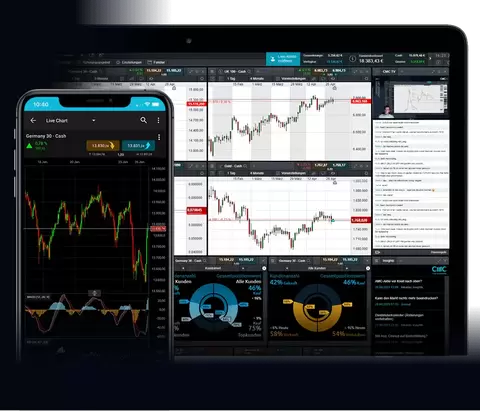

The Art of Timing: Precision in CFD Trading

In the fast-paced world of Contract for Difference (CFD) trading, mastering the art of timing can mean the difference between success and failure. Unlike traditional forms of trading, CFDs allow traders to speculate on the price movements of various financial instruments without owning the underlying asset. This flexibility brings numerous opportunities but also requires a high degree of precision and timing. In this article, we’ll explore the critical aspects of timing in CFD trading and provide actionable strategies to enhance your trading precision.

Understanding CFD Trading

Before diving into the intricacies of timing, it’s essential to grasp the basics of CFD trading. A CFD is a financial derivative that allows traders to speculate on the price movements of assets such as stocks, commodities, indices, and currencies. Instead of buying or selling the actual asset, traders enter into a contract with a broker to exchange the difference in the asset’s price from the time the contract is opened to when it’s closed.

The allure of CFD trading lies in its leverage capabilities, which enable traders to control a larger position with a relatively small amount of capital. However, this leverage also amplifies the risk, making precise timing and strategy crucial for success.

The Importance of Timing

Market Volatility

One of the defining characteristics of CFD trading is its exposure to market volatility. Prices can move rapidly, influenced by factors such as economic data releases, geopolitical events, and market sentiment. Timing your trades to capitalize on these movements requires a keen understanding of market conditions and the factors that drive price changes.

Entry and Exit Points

Identifying optimal entry and exit points is fundamental to successful CFD trading. Entering a trade too early or too late can result in missed opportunities or increased losses. Similarly, exiting a trade at the right moment can lock in profits or minimize losses. Precision in timing these points often relies on technical analysis, chart patterns, and indicators such as moving averages, Relative Strength Index (RSI), and Bollinger Bands.

News and Events

Economic calendars, corporate earnings reports, and geopolitical developments can significantly impact asset prices. Staying informed about upcoming events and understanding their potential effects on the markets can help traders time their entries and exits more effectively. For instance, a favorable earnings report can drive a stock’s price up, presenting a lucrative opportunity for CFD traders who time their positions correctly.

Strategies for Enhancing Timing Precision

Technical Analysis

Technical analysis involves studying historical price data and chart patterns to predict future price movements. By analyzing trends, support and resistance levels, and various technical indicators, traders can gain insights into potential entry and exit points. Popular tools include moving averages, which smooth out price data to identify trends, and oscillators like the RSI, which indicate overbought or oversold conditions.

Risk Management

Effective risk management is crucial for timing precision in CFD trading. Setting stop-loss and take-profit levels can help you manage your risk and lock in profits. A stop-loss order automatically closes a trade when the price reaches a predetermined level, limiting potential losses. Conversely, a take-profit order ensures that your trade is closed once it reaches a target profit level.

Backtesting and Practice

Backtesting involves testing your trading strategies on historical data to evaluate their effectiveness. By simulating trades based on past price movements, you can refine your timing and identify potential weaknesses in your approach. Additionally, practicing in a demo account allows you to hone your skills without risking real capital.

Staying Informed

Continuous education and staying updated with market news are essential for precise timing. Follow reputable financial news sources, subscribe to economic calendars, and participate in trading communities to stay informed about market developments and trends.

Conclusion

Mastering the art of timing in CFD trading is a blend of technical analysis, risk management, and staying informed about market events. Precision in timing can significantly enhance your trading success, allowing you to capitalize on market opportunities and mitigate risks. By employing these strategies and continuously refining your approach, you can navigate the dynamic world of CFD trading with greater confidence and precision.