Use Advanced Tools and Platforms for Smart Decision-Making

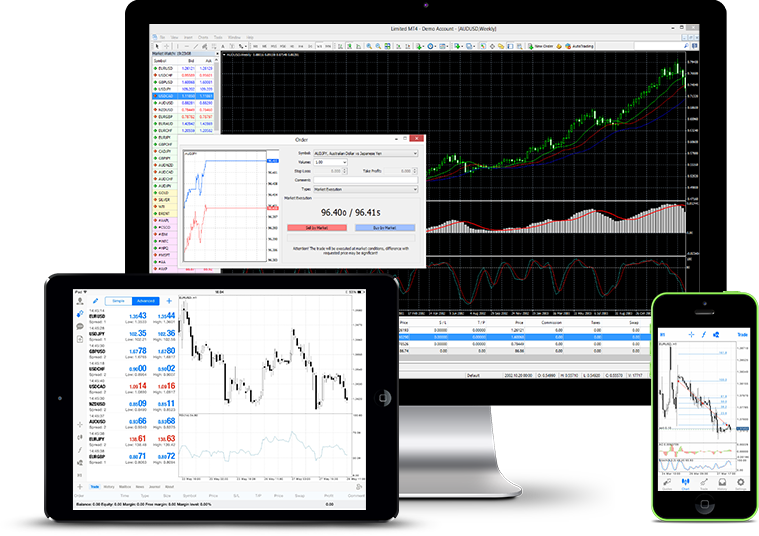

In the fast-paced world of trading, informed decisions can make the difference between success and missed opportunities. With markets evolving rapidly and data flowing constantly, leveraging advanced tools and platforms is no longer a luxury—it’s a necessity. Modern trading platforms offer a powerful suite of features that equip forex -time insights, technical analysis, and strategic planning capabilities to make smarter, more confident decisions.

The Role of Technology in Modern Trading

Trading today is driven by data, speed, and precision. Advanced platforms are designed to process vast amounts of market information in real-time, delivering actionable insights to users at the click of a button. These platforms serve as the command center for traders, enabling them to monitor price movements, execute trades, manage risk, and analyze trends—all in one place.

By using platforms that are optimized for performance and usability, traders gain a significant edge. The right tools can reduce decision-making time, improve trade execution, and provide a clearer view of market dynamics.

Key Features of Advanced Trading Platforms

1. Real-Time Market Data:

Access to live price feeds and order book information is crucial for accurate analysis. Modern platforms offer real-time updates across multiple asset classes, helping traders respond swiftly to market movements.

2. Interactive Charting Tools:

Charts are the foundation of technical analysis. Advanced platforms provide customizable charting tools with multiple timeframes, indicators, and drawing features. This allows traders to spot patterns, analyze trends, and plan entries and exits with precision.

3. Automated Trading Capabilities:

Algorithmic and automated trading tools enable users to set predefined criteria for trade execution. These features are particularly useful for executing high-frequency strategies or managing trades around the clock without constant supervision.

4. Risk Management Functions:

Built-in risk controls such as stop-loss, take-profit, and margin alerts help traders protect their capital. Platforms also offer portfolio tracking and performance reports to help assess risk exposure in real time.

5. News Integration and Economic Calendars:

Staying updated on market-moving news is critical. Many platforms offer integrated news feeds, economic calendars, and event alerts that help traders anticipate volatility and align strategies accordingly.

Supporting Smarter Decisions

Using the right tools isn’t just about having access to technology—it’s about enhancing the quality of decision-making. With reliable platforms, traders can backtest strategies using historical data, simulate trades before committing real capital, and refine their approach based on performance metrics.

Moreover, these tools reduce emotional bias by providing objective data and analytical frameworks. Rather than reacting impulsively to price movements, traders can rely on system-driven insights to make rational, well-timed decisions.

Final Thoughts

In a competitive and fast-moving market environment, the importance of using advanced tools and platforms cannot be overstated. They empower traders to act with clarity, speed, and confidence, all while maintaining control over risk. By investing time in understanding and utilizing these platforms, traders can enhance their decision-making process, improve their execution, and ultimately, position themselves for greater long-term success in the financial markets.