How to Analyse CFD Market Depth

Trading often feels like navigating a maze. You need to make strategic decisions based on available data, and one of the most insightful data sets is the CFD trading market depth. If you’re looking to sharpen your trading skills and make more informed decisions, understanding how to analyze CFD market depth is crucial.

What is CFD Market Depth?

CFD market depth provides a detailed view of buy and sell orders for a particular asset. It shows the number of pending orders at various price levels, allowing traders to gauge supply and demand. This insight helps traders predict price movements and make better trading decisions.

Importance of Market Depth

Market depth is essential because it offers a real-time snapshot of market sentiment. By examining the buy and sell orders, traders can identify potential support and resistance levels. This information is invaluable for setting entry and exit points, thereby minimizing risks and maximizing profits.

Tools for Analyzing Market Depth

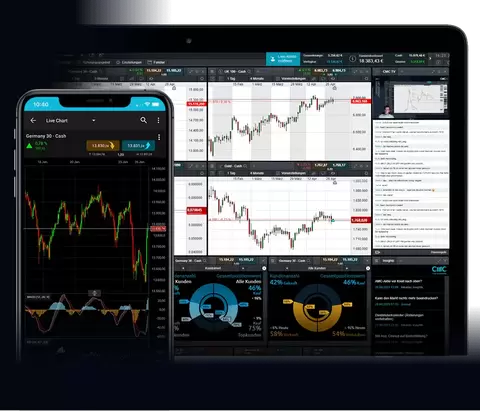

Several tools can help you analyze market depth effectively. Trading platforms often provide built-in market depth charts, also known as Level 2 quotes. These charts display the volume of buy and sell orders at different price levels. Some advanced platforms also offer heatmaps that visually represent market depth, making it easier to identify significant levels of interest.

How to Read Market Depth Charts

Understanding how to read market depth charts is the first step in effective analysis. These charts typically display buy orders (bids) on one side and sell orders (asks) on the other. The prices are listed vertically, while the volume of orders is represented horizontally.

Identifying Key Levels

One of the primary uses of market depth charts is to identify key levels. Large clusters of buy or sell orders often indicate significant support or resistance levels. By recognizing these levels, you can make more informed decisions about where to place your trades.

Analyzing Order Flow

Another critical aspect of market depth analysis is examining the order flow. This involves tracking how orders are added or removed from the market. A sudden influx of buy orders, for example, can signal upcoming bullish activity, while a surge in sell orders may indicate bearish sentiment.

Practical Tips for Effective Analysis

Effective market depth analysis requires a combination of skills and strategies. Here are some practical tips to help you get started.

Stay Updated

Market conditions can change rapidly, so it’s essential to stay updated. Regularly monitor market depth charts and be aware of significant news events that could impact the market.

Use Multiple Indicators

Relying solely on market depth can be risky. It’s a good practice to use multiple indicators, such as moving averages and Relative Strength Index (RSI), to confirm your analysis. This multi-faceted approach provides a more comprehensive view of market conditions.

Practice Makes Perfect

Like any skill, mastering market depth analysis takes time and practice. Start by analyzing historical data to understand how market depth correlates with price movements. Over time, you’ll develop a keen sense of how to interpret market depth charts effectively.

Common Pitfalls to Avoid

While market depth analysis can be incredibly useful, it’s not without its pitfalls. Here are some common mistakes to avoid.

Over-Reliance on Market Depth

One of the biggest mistakes traders make is over-relying on market depth. While it provides valuable insights, it’s just one piece of the puzzle. Always consider other factors and indicators before making trading decisions.

Ignoring Market Sentiment

Market depth shows the current state of buy and sell orders, but it doesn’t account for the overall market sentiment. News events, economic data, and geopolitical factors can all influence market conditions. Ignoring these elements can lead to misguided decisions.

Underestimating Liquidity

Liquidity plays a crucial role in market depth analysis. In markets with low liquidity, even small orders can significantly impact prices. Always consider the liquidity of the asset you’re trading to avoid unexpected price swings.

Advanced Strategies for Experienced Traders

For those who have mastered the basics of market depth analysis, there are advanced strategies to explore. These techniques can provide deeper insights and improve your trading performance.

Scalping

Scalping involves making multiple trades within a short period to profit from small price movements. Market depth analysis is particularly useful for scalping, as it helps identify short-term support and resistance levels.

Arbitrage

Arbitrage is the practice of profiting from price discrepancies between different markets. By analyzing market depth across multiple platforms, traders can identify arbitrage opportunities and execute trades to capitalize on these differences.

Algorithmic Trading

Algorithmic trading uses computer programs to execute trades based on predefined criteria. Market depth data can be integrated into these algorithms to enhance their accuracy and effectiveness.

Real-World Examples

To bring these concepts to life, let’s look at some real-world examples of how traders use market depth analysis.

Case Study 1

A trader notices a large cluster of buy orders at a specific price level. Recognizing this as a support level, they place a buy order just above this price. When the market reaches this level, the buy orders are executed, and the price starts to rise, resulting in a profitable trade.

Case Study 2

Another trader uses market depth analysis to identify a surge in sell orders. Anticipating a price drop, they place a sell order and profit as the market moves in their favor.

Learn More and Start Trading

Analyzing CFD market depth is a powerful tool for any trader looking to make informed decisions. By understanding how to read market depth charts, identifying key levels, and avoiding common pitfalls, you can enhance your trading strategy and achieve better results.

If you’re interested in taking your trading skills to the next level, consider signing up for our advanced market depth analysis course. Our experts will guide you through the intricacies of market depth, helping you become a more proficient trader.

Happy trading!